|

You’ve had a banner year in business. Despite all the craziness, the real estate, mortgage, and financial services industries have thrived, and you’ve helped more buyers, sellers, and clients than ever before. In fact, you very well have made record income this year. But now you have a bigger problem you haven’t even thought of yet: how to thank them all. A little hand-written thank you note? That’s cute. But someone just purchased a $700,000 house with you. A gift certificate to their favorite restaurant? Pretty thoughtful, but one free meal for that $12,000 loan commission you received probably falls short in their eyes. Maybe you even bought them a gift certificate to Home Depot for $100 or a gift card for $250? They could have given their business to anyone, so they’re thoroughly unimpressed. (And why wasn’t it $500?!) In fact, giving the right thank you gift is an art form It should be personal, but never have an easily discernible dollar value attached, so you don't quantify the relationship. Instead, it should be unique and custom enough that the gift forms an emotional connection, with a perceived value that's sky-high. Not only that, you want to present a thank you gift that inspires social media posts, friends and neighbors asking where they got it for years to come, and REFERRALS! Ok, so short of sending them to the Maldives to stay in one of those insanely cool resorts over the water, what should you get them? Solution: Try custom-made pillows or quilts. These gifts from Bitty Birdie Design will always be displayed in their home, will have people asking about them for years, and instantly create priceless sentimental value. For the pillows, you can have hand-stitched messages like the family name, their move-in date, the address of the home they just purchased, just their zip code, or, even one of my favorites, the longitude and latitude of their property. And for those clients who are truly raving fans of your business (you know, the ones who bought and sold with you and referred three other clients!), a custom quilt will become a family heirloom. These Bitty Birdie quilts are crafted out of anything you want, and one of the most popular is t-shirts, believe it or not. If you have kids, they probably have scores of tee shirts, jerseys and uniforms from sports, camp, school, and whatever other activities. The only problem is, they all get thrown out once the season/school year is over and especially when your child outgrows them. But now you can take all of those unused garments and turn them into an epic keepsake in the form of a t-shirt quilt. Throw in a t-shirt from the family reunion, the trip to Disneyworld, and the baby’s first blanket, and it’s a family treasure. You can even mix in squares with the aforementioned dates, names, or anything else you want in between. Your clients will be blown away by your thoughtfulness and they’ll think of you each and every time they use them. And with Bitty Birdie Design, you’re not ordering laser printed or machine-made cheap quality, because each one is hand stitched and carefully crafted. But instead of me talking your ear off, head over to the BittyBirdie.com to see what they have to offer, or follow them here on Facebook.

Do me a favor and try giving one of these to your favorite client, record their reaction for social media, and let me know how many likes, comments, and possible referrals it brings you. Just be sure to order well in advance! -Your friend, Norm :-)

0 Comments

I know we usually cover real estate and mortgage-related content on this weekly marketing blog, but I wanted to share something that's super interesting outside of the world of real estate, although it definitely still applies. A friend and client of mine, Brian Boyd of Boyd Wealth Management, is a financial planner for high net worth individuals. He recently wrote this piece for his audience, which covers behavioral finance and our tendencies to screw things up based on emotion and bias. Enjoy this excerpt from his article and there a link to the full version at the end. Thank you, Brian! -Norm :-) Psychological and behavioral biases may cause investors to make decisions with their portfolio that have a negative impact on their long-term investment success. Basically, human beings are often our own worst enemies when it comes to investing. Understanding Behavioral Finance Behavioral Finance is the study of psychological influences and biases that directly affect decisions around money. This phenomenon explains why markets often move erratically, based not on objective data but on the actions of participants who aren’t always acting rationally. These influences can actually drive investors to make decisions that are contrary to their best interest. Some common biases include: Confirmation Bias – accepting information that confirms an already-held belief while ignoring information that contradicts it. Examples: searching out news reports that support your opinion that markets are set to go up/down. Or, if this candidate or that candidate wins the election, the economy will tank. Loss Aversion - placing a greater weight on the concern for losses than the pleasure derived from market gains. Example: studies have shown that investors feel the effect of losses TWICE as much as they enjoy the satisfaction of gains. Familiarity Bias - the tendency of investors to only buy what they know and are comfortable with, at the exclusion of other alternatives. Example: a US based investor may neglect quality international stocks in their portfolios. (By the way, this is also an issue with investors in Australia, Japan, Europe, and the UK.) Anchoring Bias - becoming tied to a readily available reference point when making an investment decision. Example: judging your portfolio allocation and performance based on its most recent high-water mark. Recency Bias - over-extrapolating the recent past or present into the future. Example: assuming a current run-up or downturn in stocks will persist forever. These biases in human behavior are not likely to go away anytime soon. They’ve been ingrained in us since early humans survived by hunting and foraging for food, all-the-while mightily trying to avoid becoming food for something else! -Brian Boyd, Boyd Wealth Management To read the full article, click here. *** Just about every real estate agent and loan officer I know is incredibly busy these days, as record-low interest rates, a swell of buyer demand, and a considerable shift from city to suburbs is driving a housing market boom.

But, let’s face it, there are good years and bad years in real estate just as in any cyclical business, and just because you’re earning well into six figures this year doesn’t mean the deals will always come as easy. Therefore, whether it’s the hottest seller’s market or we see the point where REOs and short sales dominate once again, it’s crucial to take advantage of every legal and ethical tax deduction if you sell real estate or home loans for a living. After all, it’s not what you make, but how much you keep that matters! So, today I enlisted CPA Jose Ramirez of Advanced Tax Advisors to outline 10 common tax deductions for real estate agents and loan officers: 1. Commissions Paid Out Have you paid a portion of your commission to referring agents, a buyer’s agent, or anyone else on your team? Those are deductible! 2. Broker and Desk Fees Unless you’re at a 100% commission split, you’re paying some form of broker or desk fees to your real estate firm, and those can be tax deductible. Just be very careful about writing off desk fees from your brokerage AND a home office deduction, which can be a red flag for the IRS. There are different rules to follow when having multiple offices. 3. Training and Education Expenses If you’re investing in your education and skills, those costs may be deductible. For instance, traveling to seminars or training conferences can offer a host of deductions, but there are caveats. It must be real estate related (of course) and the training must maintain or enhance a skill in your field. 4. Advertising, Marketing, and Promotional Expenses This is a big one for most agents, with signage, photography, websites, digital marketing, and even purchasing leads that are commonly deducted. Even staging costs are tax deductible! 5. Licensing, Memberships, Professional Designations, and Insurance From MLS and Realtor membership fees to E & O insurance, there are plenty of write-offs for the average agent. 6. Gifts The typical Realtor gives plenty of gifts every year, from closing gifts to housewarming gifts, and even gift cards and holiday presents. But beware that the IRS has specific requirements for gift giving, such as that you can deduct no more than $25 for the cost of a business gift, a “floor” of $4.00 or less for gifts with your logo like pens, golf balls, etc., and the cost of engraving, shipping, and wrapping not included in the $25 limit. 7. Automobile Mileage No one drives around town more than Realtors, and a portion of your mileage is deductible. This deduction can be significant, particularly if you put 10,000 miles or more on your car annually. 8. Home Office Are you writing offers from home, using the computer in your designated home office, and using a home printer or fax for your real estate business? You’re due a home office deduction, just like most business owners who truly operate from home. 9. Meal Expenses If you’re not taking clients, referral partners, and team members out for food and drinks, you’re not doing this whole real estate thing right! As long as it’s truly for business purposes, breaking bread is deductible up to 50% of your bill, including tax and tips. 10. Business Items, Tools, and Stationary Expenses Any material items you use to perform the day-to-day tasks of your job may be deductible or depreciable, such as office supplies, copies and faxing expenses, furniture, a portion of your personal cell phone bill, and even your computer. *** Remember that there are very specific IRS rules for tax deductions, so refer to IRS Publication 535 and schedule a consultation with your tax planner for details! Your friend, Norm :-) P.S. Thank you, Jose Ramirez of Advanced Tax Advisors for the information! "Never get bored with the basics."

Those are words of wisdom from the late, great Kobe Bryant. Of course, the NBA Los Angeles Lakers champion tragically perished in a helicopter crash last year, but his legacy lives on. In fact, Kobe’s posthumous contributions go far beyond just basketball, as his philosophies and quotes on hard work, sacrifice, and the “Mamba Mentality” are frequently applied to business. Kobe was also notorious for his legendary training, starting to hone his craft at 4 am every morning and displaying a consistent work ethic that few have ever matched. The result was 5 NBA championships and countless records, including scoring 60 points at 38 years old in his very last game. The secret to his success? As Kobe shared with younger players he started coaching and mentoring later in his career, the Mamba alchemy was to do the fundamentals exceptionally well. “Why do you think I’m the best player in the world? Because I never ever get bored with the basics.” So, as a Realtor, mortgage broker, or any small business owner or entrepreneur, how you can apply Kobe Bryant’s advice to your marketing? If Kobe was your marketing coach, what advice would he give you about the basics and fundamentals of growing your brand and connecting with your audience? 1. Slam dunk your social media. Make sure you have a noticeable, fun, and personal social media presence. In today’s business climate, it not just an add-on, but essential. And it’s not enough to post a few random articles or sporadic photos (that come from someone else). You need to post interesting, unique, custom, fun, engaging, and helpful social media content every day. You need to create your own images, graphs, memes, infographics, blogs, podcasts, etc. – don’t just share other people’s “stuff.” 2. Your email marketing should be an all-star. Email is still one of the most effective ways to reach people with direct and personal messages, and yield some of the best results and highest ROI for lead generation. But after all of these years (and decades), 70% of Realtors and loan officers still don’t even have a weekly or monthly email campaign! Or, they send out “canned” or generic content, which is even worse. If you’re sending out “10 Spring cleaning tips” or “5 July 4th Recipes, etc.” then your email campaign sucks. Trust me - that’s just leaving a lot of money on the table. Get unique and personal with your emails, and your audience will love you for it. 3. Shoot plenty of videos for your highlight reel. Video definitely needs to be a big part of your marketing these days. Why? Remember that YouTube is actually the second-largest search engine in the world (behind only its owner, Google), Instagram is exploding and will surpass Facebook soon, and about 70% of consumers are looking for video content – especially on their mobile devices! They don’t have to be professionally shot or edited – people will actually appreciate the authenticity as you documented your life on-the-go. 4. Give back to your fans all the time - or someone else will. Your sole job is to be of service to your audience and clients, and that means touching base with them regularly, building relationships and forming friendships, answering their questions, and providing helpful information. Your competition sure is reaching out to the public, investing robustly in their marketing and outreach. Every week, month, and year that you still don’t have a rock-solid marketing system, you’re falling behind – and your competition is trying to recruit your clients to their team! 5. To build synergy, use the power of leverage. Are you really running a business? Or just trying to do everything yourself, essentially trading time and energy for money? The folks who are wildly successful in real estate, mortgage, or any industry understand that they need to build a real business to be successful. Only then can their success be sustainable and predictable AND they won’t completely burn out. The only way to do that is to leverage other people’s time, work, and skills. Once you build a team and put people in position to do what they do best, it all works like a well-oiled machine (of course, with time, training, set-up, upkeep, etc.). You’ll achieve synergy – where the whole is greater than the sum of the parts. In our industry, synergy and team building = massive profit growth, as well as freed-up time for you. Once you have this system that leverage’s other people, you can also grow and scale-up as much as you’d like, which is where the fun starts! 6. You need to build a great team to be a champion! You’d probably do a great job of being your own marketing department, but you definitely shouldn’t. Why? At your highest and best use (talking to clients, taking listings or loan apps, networking, etc.) you should easily be making about $250-$400 per hour these days. So, every time you take a few hours or the whole afternoon to wrestling with your marketing, you just gave yourself a demotion to about $20 to $25 per hour. Why on earth would you want to give yourself a pay cut? And although your ego tells you that you’ll do it better, the truth is that you’ll probably be really inconsistent, turning the marketing spigot on when business is slow and forgetting about it when you’re busy. Your marketing will be sporadic and inconsistent, and you’ll probably start skilling Every hour you spend doing these basic admin tasks instead of hiring someone, you’re missing bigger opportunities and paying a high opportunity cost! 7. Be the first in the gym and outwork them all. No one outworked Kobe, even when he ruptured his Achilles late in his career and chose to put in the torturous work to come back in his late 30s. However, too many Realtors, loan officers, or business owners don’t want to put in the time, work, or discipline to do it correctly. They may try to skip steps, hoping to fast forward through the process. They look for the next shortcut or million-dollar hack (and usually fall victim to those selling those fallacies). To do so means they’re missing the fundamentals and aren’t building your brand. Instead, Kobe would preach mastering the basics to get the most out of your marketing and lead generation. 8. Take the winning shot by investing in yourself! Learning and gaining new skills should be a lifelong endeavor. You should be setting aside time to read, study, research, grow, develop, and network with others who are doing the same. Doing so will bring tangible gains in your professional life (and income). Study the greats. Emulate them. Strategize. Hold yourself and your team accountable. And never settle for less than greatness! Not only will you see continuous growth in your career, but you’ll also gain personal fulfillment and enjoy the journey, because Kobe Bryant also taught us that we have to be our best right now, since tomorrow it’s guaranteed. *** Master these marketing fundamentals and watch your business thrive as you become one of the all-time greats, too. You’d make Kobe proud! -Norm :-) P.S. I actually hate the Lakers (I'm a Celtics fan), but respect the hell out of Kobe's work ethic and mental approach to success! How’s your business these days? Is it growing exponentially? Are you getting commission checks faster than you can cash them? Have you been absolutely crushing it? For many of us in real estate and mortgage, the answer should be “I’m having the best year of my career,” but probably falls a little short of that in reality. When I asked you that question, your first thought may have been, “It’s pretty good,” but you were really thinking about this winter or next year with a little trepidation. Or, your first reaction may have been to start making excuses about the pandemic and slow spring that was forced upon us. (An excuse may be based in fact, but it’s still an excuse!) Right now, mortgage rates are at record lows (in fact, they hit new record lows EIGHT times already this year!), and the real estate market is booming in many parts of the country. THIS is the year you should be solidifying your career and brining your income to whole new levels, but many of you (ok, many of us) are falling short of that. And money aside, is the love still there? If you’re not absolutely ebullient every morning on your way to the office or when you’re helping clients, something is robbing your joy. Here are some signs that you’re doing this whole business thing wrong:

I know that’s a lot to take in.

You may even be feeling a little defensive right now (after all, what the hell do I know and what makes mequalified to give advice?! You’re the one making big bucks in real estate or mortgage!) Well, I’ve been exactly where you are now, and I’m pretty sure I made all 15 of those mistakes – and probably some more! I’m also not going to claim that I have it all figured out and my humble marketing firm is running like a well-oiled machine. In fact, I’m actively working on fixing and implementing many of the things on this list right now, and so it’s a perfect time to share our journey. And the good news is that there’s clear path to fixing those mistakes, so you actually build a business that takes care of you instead of always scrambling to take care of your business. Next week, I’m going to break that down for you. I must confess that a lot of it has to do with the marketing side of the business, as that’s my specialty. (No, I’m not going to suggest you hire me. I’m too damn busy as it is! Haha) My only goal is to bring you a little value and insight, and hopefully help boost your career to new heights – without expending more and more time and energy. Stay tuned for part two or just hit me up if you want to talk before then. Keep smiling and selling! -Norm Schriever I still remember the feeling. During the early days of the mortgage meltdown in 2007, I was working in real estate and had just written a cheque for $30,000 to buy into a small mortgage company. And then, only weeks later, it all came crashing down. The rest is history, as they say, but I want to focus on is the feeling I had every single morning - you probably remember it well if you were in the business. I woke up every single morning with a sining feeling in my gut, a slight buzz of panic always in the background as I put on my tie, tried to put on my best face, and drove to work. And all day long, it was like getting kicked in the stomach (or someplace a little lower!)...and coming back for more, again and again. I also recall how hopeless it felt, like my choices shrank until it felt like I was working in a tiny phone booth with no oxygen. If you're a Realtor or lender who was working in those days, you probably have similar recollections, and our current climate economic climate may stir those old, unwelcome anxieties. For now, we've been miraculously spared by low interest rates and hot buyer demand, so I'm sure it was easy to dismiss those feelings and go to work with a smile every morning. For now.

In fact, our heightened anxieties may be leading us to make questionable decisions that only dig a bigger hole. And if you’re like most people in our modern society, stress, fear, and anxiety are an unfortunate part of regular life.

And let’s be honest – a good portion of our stress and worries in life come from finances.

And those numbers are BEFORE the Covid-19 pandemic when 40 million people lost their jobs and 4.8 million people stopped making their house payments! Needless to say, we’re all concerned, deeply worried, or even in panic mode over our finances these days in some capacity. Add in an unprecedented level of fear over health concerns, whether the kids will be able to go back to school, and the mental health effects of social isolation or losing loved ones, and our cortisol levels (the fight-or-flight hormone) are continuously in an elevated state. So, what does that do to the decisions we make? Will an abundance of fear, stress, and anxiety help or hurt us when we’re faced with critical choices? And as a business person who is in sales and maybe an entrepreneur, how might we see the effects of our stressors and anxieties on day-to-day decisions? The data on decision-making and stress or anxiety. A host of studies show the profound effects of stress on our decision-making process, but I’d like to highlight a few:

Here are 5 ways stress affects our decision-making: 1. We become reactionary When we're in a state of stress, anxiety, or fear, our brains emit high levels of cortisol, which is known as the "fight or flight" hormone. In this heightened state, our perceptions are more acute, and we tend to be far more reactionary. While cortisol and an adrenalized state helped us when we were running from dinosaurs or fighting off invaders, it doesn’t serve the modern human well, as prolonged cortisol levels are harmful to our health – and cause use to be reactionary with our decisions at the exact time when we should be more careful, critical, and measured. 2. We disproportionately focus on the positive You may think that high levels of stress prompt us to see the world as all doom and gloom, but the opposite may be true. Research shows that acute stress actually leads our brains to ignore negative consequences and focus on the positives, or pleasure, instead. That's right – we're more likely to cling to any positive feedback or hope for positive outcomes when under stress instead of facing the reality of negative consequences. 3. We may think our options are binary One of the key findings of how our brains make decisions under stress is that we inadvertently restrict our options and solutions until we may think only two choices remain. We think that our only options are to take the job or not take it, to buy the service or not buy it, etc. But in the real world, our options are never binary (yes or no), and there are a multitude of solutions we can find if we only have the clarity to problem solve. Unfortunately, when under stress, our menu of perceived options shrinks down to very few, which forces our hand with some bad or limited decisions. We should entertain more options when under fire and facing stress and anxiety, not less! 4. We come up with quick fixes instead of problem-solving When we're feeling the strain of fear or anxiety, we're also likely to make decisions much more quickly (which isn't necessarily a good thing). Perhaps it's our fight-or-flight instinct kicking in, but our thought processes, problem-solving methods, and decision making tend to be rushed when the heat is on. That may allow snappy, definitive decisions in combat or in the face of an emergency, but they don't help us in day-to-day life when it comes to decisions about finances, business, relationships, or other important life choices. 5. We abandon our normal decision-making process There are two basic types of decision-making processes, which are based on your personality type. Some people are analytical, crunching numbers, taking in as much information as possible, and weighing all options such as a chess player who scrutinizes all of their moves carefully. The second personality type relies on their instincts and makes gut-level decisions, “going with the flow” and counting on their intuition when pressed to make a choice. The fact is that neither method is right or wrong, and by sticking to the decision-making process that feels best to that individual, they build up a lifetime of practice and hone that skill. However, when feeling the stress or pressure, we tend to abandon our comfortable and trusted method of decision making. Those who rely on instinct start crunching data and information; analytical people throw that out and go with their gut. While we just noted that neither of these methods are wrong, you shouldn’t switch course and try a new, unfamiliar, or un-practiced decision-making process when under stress! Do men or women make better decisions when under stress? Interestingly, research has pointed to some inherent differences in the decision-making process of women and men. A study at the University of South Carolina found that under pressure, men took bigger risks than women, who were significantly more conservative. So, when forced to make decisions or solve problems under stress, women tend to take more time, weigh their options, and become more analytical, while men make snap decisions. To account for these patterns, researchers point to differing responses in the anterior insula and dorsal striatum, which moderate our choices when rewards (like money) are on the line. It turns out that women may make better decisions when under stress! *** The good news is that no matter who you are, there are ways you can be conscious of your decision-making patterns and work to correct them as needed. There are also plenty of ways to naturally reduce your anxiety or be more clear-headed when making decisions, like deep breathing, meditation, exercise or fresh air, and positive visualization. -Norm :-) PS This article first appeared on Kelly Resendez' Foundation To Sustainable Success. Thanks, Kelly!

Sources: https://www.psychologytoday.com/us/blog/the-athletes-way/201603/how-does-anxiety-short-circuit-the-decision-making-process https://www.psychologicalscience.org/observer/under-pressure-stress-and-decision-making https://hbr.org/2017/08/stress-leads-to-bad-decisions-heres-how-to-avoid-them https://healthland.time.com/2012/03/05/decision-making-under-stress-the-brain-remembers-rewards-forgets-punishments/ Directions in Psychological Science. Northwestern Mutual Capital One & The Decision Lab The problem with most marketing: There's a lot of money being thrown around by the mortgage industry these days. Firms are investing in digitalization, data, and recruiting more than ever, while individual loan officers look to boost their marketing and ad budgets. With record-low interest rates, a preponderance of home equity to work with, and strong homebuyer demand, it's no wonder why the mortgage industry is doubling down on client acquisition. However, from the largest firm spending millions to the solo-preneur trying to keep up with their own marketing, a lot of that money is being wasted for one simple fact: They’re doing it wrong! This is another fantastic guest blog by my good friend and industry icon, Kelly Resendez. You can get to know Kelly better or contact her here. In fact, there’s one fundamental snafu that many brands and organizations make over and over; their marketing is all about them, not their clientele and audience.

The good news is that this pivotal error is also incredibly easy to fix, and the shift will reap huge financial rewards almost immediately. How do you flip that switch? Stop talking about your own firm, service, or process in your marketing, and start focusing on your customers. “Make the customer the hero of your marketing story,” as presentation and sales expert Tom Bresnahan puts it. Let’s take a further look at how (and why) to do just that. The transformative solution: According to a comprehensive study by Rutgers University, all marketing content falls under one of two umbrellas. “Meformers” mostly talk about themselves with their marketing messages, posts, and images. While “Informers” do the opposite, turning their lens to the outside world by focusing on their customers or audience. Informers post marketing materials that provide value, solve problems, acknowledge people’s challenges, and share experiences. Basically, they tell a whole lot of stories about others – not themselves. So, that loan officer whose "marketing strategy" consists of posting nothing but selfies (we all know that person!) - he or she is a "Meformer." But the professional who posts tips, hacks, resources, educational facts, community news, and especially tells the stories of the clients they help is thoroughly an Informer. And the benefits to being an Informer are profound. Stats and facts that prove Informers win:

It’s not only advertising campaigns that illuminate this crucial chasm, but regular day-to-day social media marketing.

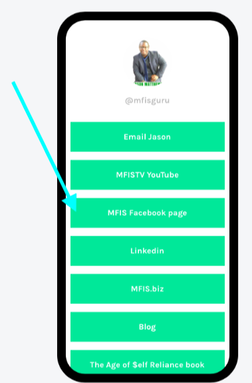

The tangible benefit to this marketing shift: By “turning the marketing lens outward,” you’ll engage and connect with consumers on a whole new level. These days, that’s a necessary tactic since they’re inundated with marketing and advertising messages at a mind-boggling rate – including from your competitors. Did you know that the average person is bombarded by more than 3,000 commercial messages every single day?! But you’ll stand out, develop an authentic relationship, and build brand loyalty once you look to make the consumer the hero in your marketing stories. No longer is it sufficient to intercede and reach them right before they make a buying decision or certain consumer triggers pop up, like credit score checks, home value estimates, or home searches, etc. Instead, you’ll share their journey every step of the way, offering advice, information, resources, help, and a lot of genuine investment in the relationship. They’ll already understand the value your firm provides and trust you to provide solutions via your services. Your audience will love you for it! Your audience will appreciate that you’re authentically interested in their lives and experiences, and that’s backed up by mountains of data. For instance, 77 percent of people surveyed are brand loyal according to HubSpot, and 90 percent of consumers trust brand recommendations from friends online. The best part is that by making your marketing about THEM, you'll see a significant uptick in user-generated content, like when your clients share photos, recommendations, shout-outs, testimonials, and other endorsements. That’s HUGE – the Holy Grail of any marketing – as 70 percent of consumers trust content and endorsements from regular people (over brand-sponsored marketing), and 61 percent are more likely to engage with an ad if it includes a real customer or regular person. That’s fundamental to your success (and a spike in profits!) since repeat clients or referrals from past clients convert at a 65 percent rate compared to just a 13 percent closing rate for new prospects. *** I recommend you sit down and map out your marketing strategies to see if you fall in the Meformer or Informer category. -Norm :-) I’ve got something really cool for you today that solves one of the biggest problems with Instagram: that you can only post one link. Of course, Instagram allows you to write links into your posts but they’re not clickable. So, they’re almost useless, as a few people in your audience MAY type out a very short URL themselves but NO ONE will take the time to type out and recreate the typical long URL. You are allowed one clickable link on Instagram – which sits in your profile bio. Until now, you had to choose between that link going to your website, Facebook page, a landing page, etc. – but only one. That also made it extremely difficult to share blog posts and other content that’s updated frequently, as it was too much work to keep swapping in a new link. Thankfully, that problem has been solved with Linktree.  (Note: I’m not affiliated in any way or make a penny if you use Linktree – it’s just a cool and useful tool.) There still is one link in your Instagram bio, but you share a URL link to your Linktree account. When someone clicks on it, they’re brought to a simple and clean webpage that lists a series of your other accounts – with clickable links. Let’s look at the Linktree setup I just made for a good friend and client, financial guru Jason Matthews. When someone clicks on his one Instagram link, it brings us to this landing page, where we share clickable links to his:

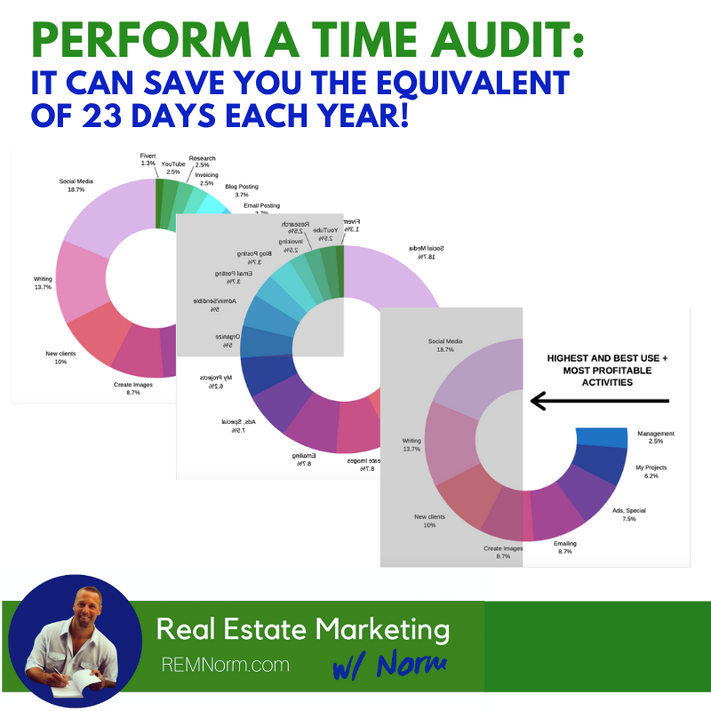

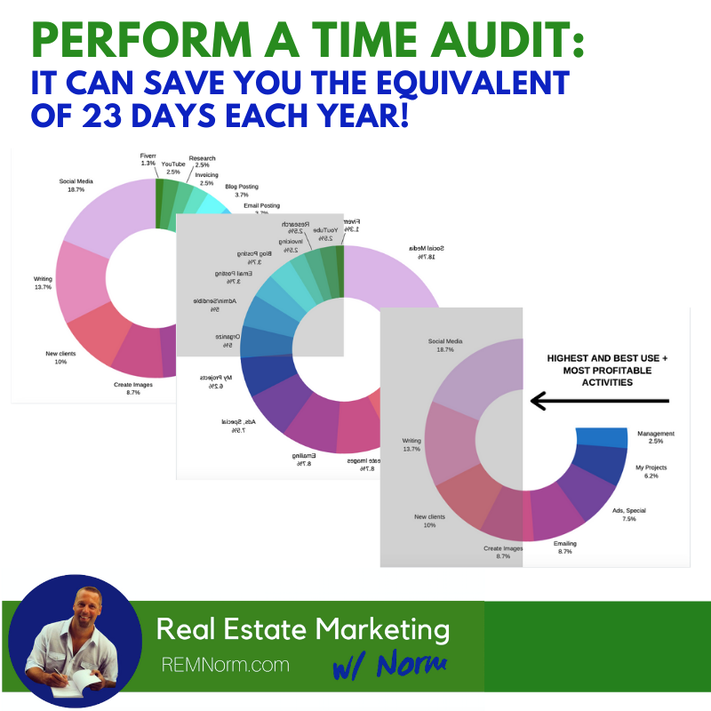

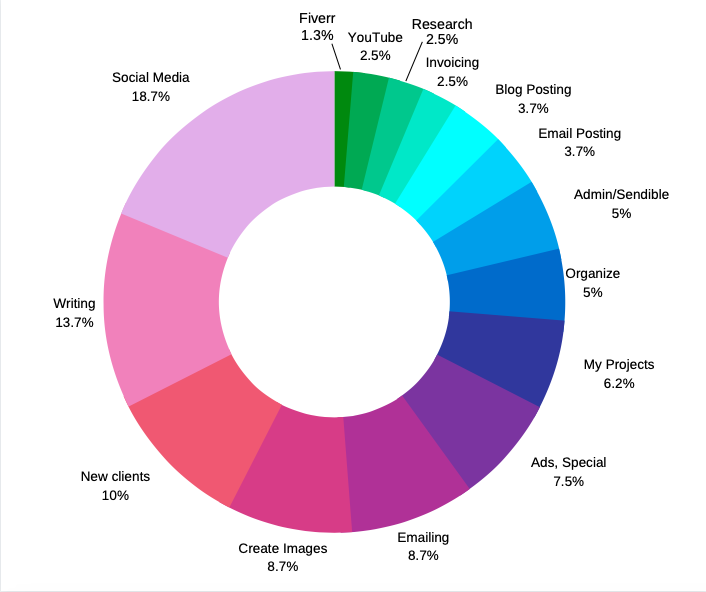

That’s pretty cool – and definitely increases the avenues for someone in your audience to connect with you!  You can even personalize your Linktree page by uploading your logo or photo. The best part is that Linktree has a free plan (I swear I don’t work for them!) which lets you do all of the basics. But the Pro version is only $6 per month and offers video links, link thumbnails, email signup links (that’s huge for growing your database), SMS links and much more. With Pro, you also gain detailed analytics, direct syncing with social channels, and a bunch of other stuff that sounds useful. I’m sure I’ll jump into the Pro version of Linktree soon for myself as well as a few select clients who want to take advantage. But remember the website is not Linktree.com but www.linktr.ee Check it out and have fun! -Norm :-) *** I’m happy to set up your Linktree account for you, so you can then share the new URL in your Instagram bio. Just hit me up if you’d like me to do that for you – no charge or strings attached. Many of us are working harder than ever these days, on the grind from early morning until well into the evening. But, are we being more productive than ever? And are we just on a hamster wheel, or are we actually working towards a day when we’ll be able to step away from our business a little bit, but still see it march on? And, just as importantly, is there a vast discrepancy between how we think we spend our time and how we actually invest our professional hours? This is not your typical time management blog There are plenty of blogs, articles, and guides that give you advice about time management. This isn’t that. Instead, my goal is to share my own personal experience with an experiment I recently conducted, a Time Audit. A month ago, I was faced with a unique situation: I had more clients than ever before and even got to the point where I even had to turn down potential new clients. I feel extremely blessed and thankful to have that abundance of clients but, since I’m a lone wolf, I actually have to do all of the work every day! In the past, I’ve worked 60 hours per week with 25%-50% less clients, so how the hell will I keep up now? I decided to perform a Time Audit to see exactly how I was spending my time and how I might become more efficient. I broke this time audit into 3 steps: Step 1: Document EVERY activity and how long it takes. When you start a financial budget, the first thing they’ll ask you to do is sit down and account for how every single dollar is spent over days, weeks, and a month. I decided to do the same thing with my time. So, over three weeks, I recorded every single work task I performed. I did this on a simple spreadsheet with the activity and then the time block it took. I round up to the nearest 5 minutes to account for transitions. I used a simple Excel spreadsheet and just kept adding to it each day, separating days with a new column. I’m not going to lie – this was a pain in the ass at first. But, after the first day or so, it was second nature and actually made me more conscious of what I was doing. Step 2: Organize, categorize, and add it up After each week, I went through and added up these activities based on certain categories or tasks that I regularly perform. For me, these were:

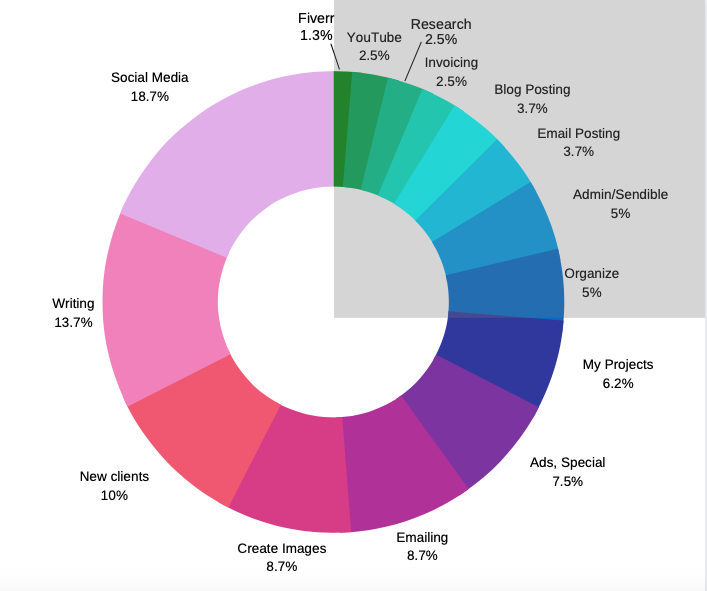

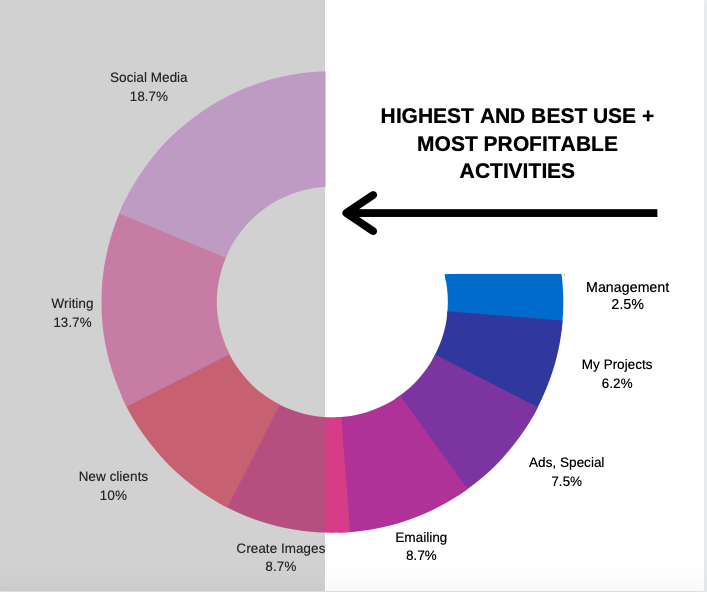

Ok, maybe I’ll leave the last one off. Once my time audit concluded, I took the weekly tally for each of these categories (in minutes) and averaged them per week. I also could see the average number of hours I worked each week in total. Next, I created this spiffy-looking pie chart with a percentage of each task or activity in relation to my total hours. So, if I worked a 40-hour week or 60-hour week, the percentage I spent on each task would be roughly the same. Step 3: Identify the results…and opportunities for change With all of these numbers in front of me, I had new insight as to how I was actually spending my time. Next, I looked at the bottom 20% of 25% of the tasks I did, which were mostly administrative or low-skilled activities. Those are the areas I could hire someone or outsource, saving me 20-25% of my time each week. Sure, I’d have to add a few hours to hire, train, and manage that person, but that amounts to trading a few bucks to recapture invaluable hours. Remember that most people do the opposite, trading their time for money, which is NOT how you want to run a business. (I’m guilty of doing the same!) I also highlighted the half of my activities from the right side of the chart. Those highlighted activities represent your highest and best use as a professional. You’re never wasting your time or energy doing those things, and that’s what you should be trying to immerse yourself into more, not less. Not coincidentally, those are also your most profitable activities. It’s why you get paid the big bucks (and where you’ll get paid bigger bucks if you invest more time in those activities.) If you’re doing it right, you’re spending the most time on those tasks and activities that you’re great at.  Now that my time audit was done, what did I learn?

Many times, I was actually reenergized after spending time at work because I really believed in the client, the mission, or what I could do to help. Basically, my perception of time was warped on a continuum by the kind of energy and emotions I felt about the work I was doing. *** Why is this time audit so important? After performing this audit, I know where my time is going, where it’s best allocated, and what tasks I should prioritize. I can also slow down and do a better job since I don’t have to feel rushed or overwhelmed. I now see the opportunity to hire someone or outsource to free up a few hours and take a lot of ticky-tack work off my hands. Recapturing the opportunity cost of time. Maybe hiring someone to take those bottom 20% tasks, combined with my improved efficiency, only frees up one hour per day. But that’s one hour I can reinvest into my most productive activities that clients really hire me to perform. I can also use that hour for learning, research, and stepping up my game, which benefits my clients. I can also spend that hour exercising, reading, meditating, or on personal development. Even better, that’s one hour (and a whole lot of energy) I can use to connect and help people, which is really what it’s all about for me. What would you do with an extra 23 days each year? Even one hour per day adds up quickly. That comes to:

That’s crazy – recouping or adding 23 days per year just by performing a time audit! I hope this helps and have fun with your own time audit – let me know if you have questions or need help! Your friend, Norm :-) How to expand your business when everyone else is contracting - a guest post from Kelly Resendez5/20/2020  Kelly Resendez, VP of Talent Acquisition at Loanpal and success coach at the Foundation to Sustainable Success, was kind enough to offer this guest post, originally published here. Enjoy Kelly's words of wisdom and get busy with your business expansion! How to EXPAND your business when everyone else is contracting.

In 2008, Steven Jobs gave an interview to Fortune Magazine in which they asked him about Apple’s strategy for the coming Great Recession. Jobs said, “In fact we were going to up our R&D budget so that we would be ahead of our competitors when the downturn was over. And that’s exactly what we did. And it worked. And that’s exactly what we’ll do this time.” Instead of paring down R & D, laying off workers, and shuttering stores to withstand the economic storm, Jobs was focused on actually growing Apple, gaining market share in the season where most others were contracting and playing it safe. In fact, many of the top companies and brands do exactly the same, and that’s one of the chief reasons why they last and stay on top. But you don’t have to be a Fortune 500 company or blue-chip brand to grow your business in the coming months and years. Every salesperson, entrepreneur, boutique broker, and small business owner has the tools to succeed even as fear pervades our business climate (and rightfully so). Sometimes, the hardest thing to do is act boldly and confidently when others are in safe mode. Our natural reaction is to:

It all starts with a 180-degree mind shift, a focus on execution, and a whole lot of hard work. But there is absolutely no reason why you can't bring your business to new heights! Here’s the game plan to expand when everyone else is contracting: 1. Invest in new skills and education It's time to learn and adjust to the new reality as fast and effectively as you can. Luckily, there are more courses, books, talks, and tools available to us online than ever, and most of them are inexpensive or free. 2. Systematize Instead of resting on your laurels, break your business down to the smallest blocks and build it all back up again, ensuring your system and operations are superbly efficient. 3. Leverage The difference between a solo-preneur and a true business owner is that the biz owner leverages other peoples’ time, energy, and skills. Stop trying to do everything yourself and start taking advantage of others and what they do well. 4. Look at partnerships/Team up Of course, there will be plenty of businesses going under or looking to downsize, and there’s no shame in that. But it also creates a golden opportunity to entertain strategic partnerships and build teams that help you expand quickly. 5. Network The average person brags about their victories when times are good, but you won't hear a peep from them in tough times. You should do the exact opposite, becoming a networking machine and reaching out to everyone you can. Create connections and authentic relationships, as they'll pay off in huge, unexpected ways down the road. 6. Help others That's what it's all about, and in dark days, your best product should be help. Focus on solving problems, bringing value, offering solutions, and empowering others to overcome their challenges. Become the person they turn to for advice and guidance. With that, your business will soar as high as the economy sinks. 7. Create new content Throw out the blueprint from last year, last month, and even from yesterday. Create a brand new marketing and outreach campaign and create blogs, emails, videos, podcasts, webinars, graphics, and social media every single day. That's how you expand! 8. Be the best communicator you know Double down on points of communication and customer service with clients, and actively practice your listening skills. 9. Cut the bottom 20% Just like an arrow needs to be drawn back to propel forward, we need to pull back, first by identifying and cutting the 20%. Just like an arrow needs to be drawn back to propel forward, we need to pull back by cutting inefficiencies according to the 20% Rule. Drop the 20% of your products that don't sell, the 20% of your employees who are lazy or aren't producing, and simplify the 20% of your day that consistently steals your time, energy, focus – and money. 10. Recruit To survive and even thrive through a recession (or depression), firms need to actively attract new personnel. Recruiting will be paramount over the next few years, and you should sign as many talented, battle-tested, and hard-working people from your competitors as possible. 11. Negotiate with vendors If times are hard for you, they’re even harder for vendors, suppliers, and distributors. So, instead of canceling or doing without, renegotiate every product, service, and lease for lower prices, better terms, and added perks. 12. Nurture your people Just like we talked about enhancing your own skills, do the same for your employees and partners by offering more training, guest speakers, education, and personal development than ever before. Investing in people always pays off! 13. Increase marketing and advertising output People invest in marketing and advertising out of greed (when times are good) but tend to shut off that spigot when times are bad. Do the exact opposite, as effective marketing campaigns are vital to keeping your firm alive and well. 14. Measure We’ve talked a lot about investing and not cutting back, but don’t do that senselessly, of course. Instead, set clear goals for every dollar that leaves your pocket and carefully measure the effectiveness of everything you do. If it doesn’t measure up, make the appropriate changes and cut it! 15. Rewrite the rules I truly believe that when markets crash and the economy shrinks, it creates a proportionate amount of opportunity. Your job is to identify and take advantage of those opportunities. That starts with putting fear and uncertainty in a box when you come to work every morning, and instead making clear, big-picture decisions. Remove the limitations and raise – not lower – your goals and dreams. It’s up to YOU to rewrite the story of your success! *** -Norm :-) |

Categories

All

Archives

December 2020

|

Get in touch: |

RSS Feed

RSS Feed