|

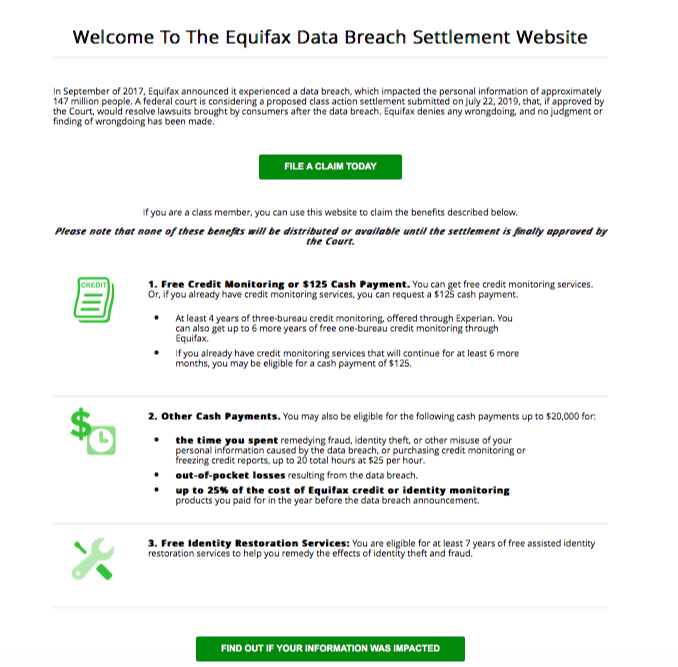

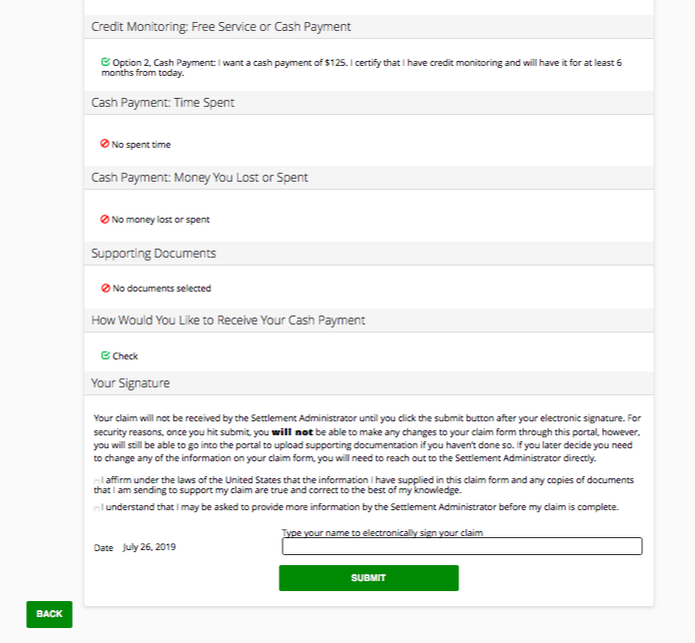

Last week, Equifax was slammed with a court-ordered settlement for their 2017 data breach that could seriously impact consumers – and this time, in a good way. One of the Big Three credit bureaus, Equifax was ordered to shell out about $700 million to those affected by the breach that saw sensitive financial information hacked, stolen, or compromised. In total, that adds up to about 147 million Americans! While you may be tempted to run and file your own claim right now, you can also seize this opportunity to grow your business, using the Equifax payout news as a valuable marketing tool. I suggest that you offer sound information and guidance regarding the Equifax settlement, positioning yourself as the go-to resource to help others access their settlement funds. Basically, you’ll be marketing by helping people get “found” money. How cool is that? First, I’ll talk about the settlement itself in this blog. Then, how you can use that as a marketing tool in the second half of this post (so scroll down if you’re already well-versed on the Equifax settlement news). How the Equifax settlement payout works for consumers: The first step is finding out if you’re eligible for a payout. To do that, you just need to go to the Equifax website: https://eligibility.equifaxbreachsettlement.com/en/eligibility Enter your name and the last six digits of your social security, and you'll find out instantly if you're part of the class-action suit against Equifax. If they confirm that you were affected by the data breach and included in the settlement, go here: https://www.equifaxbreachsettlement.com They’ll ask you a few questions about what compensation you’re claiming, where you want it sent, etc. I just went through the process there and within five minutes, found out that I was a victim of the Experian data breach (which I already knew), filed my claim, and confirmed that I’ll receive a check for $125 within 90 days. There are options for how much you’ll recover. The standard is about $125 just for being included in the data breach, although you can file a custom claim to recoup time, money, or other financial detriment (like if your identity was stolen, cards used fraudulently, etc.) But those claims can go as high as $400. Equifax is also offering compensation aside from cash, like ten years of free credit monitoring for all three credit bureaus. It's pretty simple, but there are a few finer points to understand, especially if you want to apply for a payout larger than $125. Those include what documentation you need to provide, the evidence you need to show to demonstrate a greater financial loss, and more. Who wants and needs info about the settlement: Who wouldn’t want to know if they were eligible for “free” money? (I put free in quotes because it’s not really free if you were a victim of the data breach, but it’s money due to you.) You'd be crazy NOT to go through the process at some point to see if you're due $125 or more! So, we're talking about countless millions of people – no small opportunity. Remember that even if people weren’t affected by the Experian breach or aren’t due any settlement money, they could still use your help/this guide just to find out if that’s the case or not. You should reach out to your entire database of past clients, contacts, social media followers, and the general public in the city, region, or state where you do business. Using the Experian settlement as a marketing tool: There are plenty of ways you can create and share content around the Equifax breach, getting your name (and company name) out there at the same time. Some marketing ideas include: • Write up a blog with the high points and facts of the Experian data breach and the big payout news. • This can be as basic as “Claim your Equifax settlement in these three easy steps,” or “10 Tips for getting every dollar you deserve from the Equifax settlement,” or something similar. • In it, instruct your clients how to check to see if they are due settlement money and how to make a claim. • Share this blog on your social media pages. • Also, send out an email newsletter (or just an email to your database) alerting them of the Equifax news and giving a link back to your blog. • Create a visual graphic on social media giving basic information. You could create a whole series of graphics, each offering a single fact or tip. • Film a short video talking about the Equifax settlement and offering more help. • No matter what form of content you create and how you get this information out there, offer to help anyone who needs it and list your email, phone number, and social media accounts, of course. The best part is that you’re basically just using the same information in different forms (email, graphics, video) and sharing it across multiple channels. LEVEL-UP TIP: If you really want to use this Equifax news to 2X your database, do this: Set up a simple landing page on your website that offers a free guide they could download if they input their email address and name. Run a Facebook and Instagram ad that offers this helpful free guide to people in your local area (or wherever you want clients to come from) once they enter their email and name and watch your email and phone start jumping like popcorn on a hot stove. The benefits to you and your business: Use the Equifax news as a great talking point or item of value. This will be warmly received ($125!) and a great excuse to reconnect with your database, gain an exponential number of new followers, and stir up conversations with past clients. • Grow your database • Establish authority • Create significant public interest in you and your brand • Generate local press or media interest • Add value to your clients and audience • Show that you really care and are looking out for them! • A chance to get people calling, emailing, and messaging YOU instead of the other way around. Engage in a natural conversation that touches on their credit, their home, the market, and if it’s a good time to buy or sell – or just refinance (because it is!). Remember that as a Realtor or mortgage lender, credit scores and reporting are part of the range of topics you should be well-versed in (no credit = no loan = no house!), so this news is a perfect opportunity. You don’t have time to set this all up? Of course, I know you’re busy selling houses and helping people refinance their mortgages, so I’m not assuming you have time for all this. Don’t worry about doing this all yourself – I can do it for you. Need help writing that quick guide, writing the blog, email newsletter, graphics for social media, and running an ad? Just contact me and I'd be happy to help. We could get it up and running this week because people are looking for this information! -Norm Schriever :-)

0 Comments

Real estate and mortgage marketing Q&A: Should I run Facebook ads, Instagram ads, or both?7/24/2019

So, today I enlisted someone a lot smarter than me - Jordan Glickman of ImpremisMarketing.com to chat briefly about the pros and cons of Facebook ads to generate leads versus ads on Instagram, and how they're sort of the same thing (but not entirely). Give it a watch and I'll summarize a few bullet points below. Great info from Jordan, who is world-class when it comes to running ads that get businesses new leads and clients. Here are a few key takeaways:

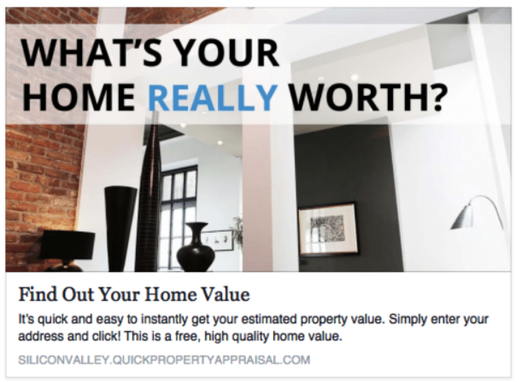

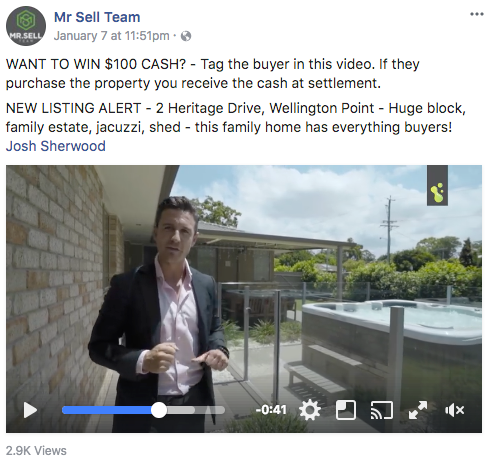

So, the answer is probably that you should be doing both - if you take your business seriously and want to not only generate leads this year, but ride the wave of future homebuyers, sellers, and home loan prospects. Hit me up any time if you have more questions for me or want some help with your marketing! Go get 'em! -Norm :-) Everyone’s talking about Facebook ads these days, especially in the field of real estate and mortgage lending where a simple ad on a shoestring budget could generate a ridiculously high ROI. I’m getting more and more emails and messages asking me to break down best practices for setting up Facebook (and Instagram) ads. That content is coming soon, and we’ll have a whole lot to cover from geo-targeting to landing pages, remarketing to A/B split-tests. But before we go behind the scenes and “learn how the sausage is made” (my new favorite saying), I wanted to remind my Realtor, loan officer, and small business peeps that it’s not just enough to upload any stock photo, write a quick line of text, and start throwing money at your Facebook ad, expecting to see great results. Just like any other form of marketing, you need a high-quality ad with a specific purpose, laser-targeted demographic, clear call to action, and enticing offer waiting on the other side of their click. Many of these will also work best with a separate web landing page (where they receive their free download in exchange for their email address and contact info) or the landing-page-like platform that Facebook offers. So, today I wanted to share my 25 Facebook (and IG, since they are interconnected) ads that have proven to be ridiculously effective for real estate agents, mortgage lenders, or any small business. This isn't HOW to run ads, but WHAT KINDS of ads to run that will maximize your results. Of course, a lot of these pertain to finding customers who need to buy or sell a house, but I’ll cover a few tactics for mortgage lenders looking to attract new clients for a refinance and widen their network of Realtors for referrals, too. (By the way, so few mortgage lenders are advertising on Facebook – only about 3% compared to the number of Realtors running ads, so opportunities are wide open!) Let’s get started! 1. Open house and listing ads An easy place to start is advertising your open house through Facebook. Research shows that you’ll get the greatest result if you run the ad for at least 5-7 days before the actual open house and include both people who live in that radius as well as those who have been there recently (checked in at local businesses, etc.). Of course, you'll ask them to register to see the open house and receive a free listing report, getting their email. 2. Home value report Other than advertising listings, this is probably the most popular form of ad-into-a-lead magnet you’ll find, and it does work well since everyone loves to hear how much money their home is worth. 3. Value change alert! Did I just get your attention? This is an AWESOME ad that I get great results from. Notice how it doesn't say that the value in their neighborhood (or their home) has gone up or down, just that it's changed significantly. That will get them clicking to find out! 4. Survey We're always asking people to buy, sign up, and do business with us, so it's a relief when we just want a consumer's opinion in the form of a quick survey. Add in the incentive that they'll be in the drawing for some sort of prize or giveaway and this will be one of your most effective ads for building your email list – and getting to know your core target demographic. 5. Attention Investors Click for a list of houses under $200,000, multi-family houses, etc. 6. Mistakes This can be for home buying mistakes/listing mistakes/home loan mistakes, etc. Negative-slant blogs, articles, and ads really get people responding to your Call to Action, as psychological research shows that people are more afraid of making mistakes and losing money than they are motivated to earn money! 7. Event Are you helping with a charity event, client appreciation night, or educational seminar? Advertise it on Facebook! 8. Market report A good old-fashioned report with real estate marketing conditions can be a great lead magnet from a Facebook ad. This one is very consistent and easy to set up. 9. Seller Checklist that will save you $30,000! This one works ridiculously well, as you breakdown a list of everything the average seller can do to save up to $30,000 on their listing (or some amount you deemreasonable). Of course, it's based on existing data and national averages, but you'll basically make a case study for curb appeal, listing and marketing correctly, etc. 10. Buyer checklist You can do the same thing for homebuyers, giving them a few tips, tactics, negotiation strategies, etc. to save money (and avoid pitfalls). 11. Welcome to the neighborhood! Download your neighborhood report with the best restaurants, shops, and amenities in the area, as well as a list of schools (not rankings!), parks, and other helpful info! 12. A luxury living ad that speaks to their sophistication A Harvard study found that ads that were more subtle or discreet and complimented the viewer's sophistication worked exceptionally well, especially for luxury markets. You can also substitute hard-working, intelligent, discerning, having good taste, etc. for sophistication 13. Human interest/profile piece We’re always so focused on the nuts and bolts, but an ad that highlights you as a professional but even more so, family man/woman, community member, etc. is highly effective in garnering interest. Again, this works best with a short, professional video, but you’ll get a lot more clicks and leads off of it than you might anticipate. Personal and humanizing content is good! 14. Lifestyle-targeted ads Golf? Cycling on the nearby bike trails? Walking distance to everything? Downtown/midtown living? Make an ad that speaks to that! 15. Ad aimed at out-of-town buyers and investors As an example, run an ad in the San Francisco/Bay Area about the affordable prices and golden opportunities if they buy in Sacramento. I'm not sure why more Realtors don't do this! Ok, mortgage lenders; Most of these can be adapted to lending, like how to avoid common mortgage mistakes instead of home buying mistakes, etc. But I have some great ads for you, too. 16. 3 Homes with 3 Payments ad Run an ad with three houses, ranging from smaller to bigger and nicer and write in that all three of them have the same monthly payment. (Based on three different lending scenarios/home loan programs/pricing, etc.) People will click just to see how you plan to pull that off! 17. Refinance savings report Did you know that Fannie Mae estimates that 10 million US homeowners would benefit from a refinance, potentially saving them a collective $500 billion in mortgage payments? (Or something like that). Are you one of them? Click here to find out. 18. Can I save you $32,467 on your home loan? Any variation of that savings-with-a-refi ad above will work but put in a very specific number for the dollar savings based on projections for the average refinance. 19. Rent versus buy If you’re going after the first-time homebuyer market (Millennia homebuyers will be coming in drove soon!), you can run an ad demonstrating the benefit of buying versus renting in several ways, from being funny and visual to offering reports with actual hard data. 20. Ad for a first-time buyer checklist A checklist or guide for first-time buyers is easy to put together and will get you a lot of activity. 21. Prize/raffle/giveaway Whether you’re a Realtor, lender, or offering any product or service, don’t forget that you can supercharge your ad results by offering a prize/raffle/giveaway. In fact, that can be the whole ad and you’ll get tremendous results for click-throughs (to expand your email list and social media audience, if not outright leads)! 22. Get pre-approved in seconds A quick prequalification ad that leads to your website and the auto-prequal matrix. 23. “How to save $______ on your next home loan” Run an ad and show them the benefits of a 15-year versus 30-year mortgage, rate buy-down with points, etc. 24. Target realtors working in your area – you have buyers? Interest rates are so low now that most lenders are busy with refinances, but I notice that a lot of my clients are playing it smart and keeping 50% of their focus on Realtor relationships and referrals. One way to cast a wider net is to run an ad proclaiming that you have buyers who may need a Realtor to help them. Of course, you’ll want to actually deliver on this promise. 25. Free weekly marketing tip offered to lenders You can target by occupation with Facebook ads so run an ad offering a free weekly marketing tip or mortgage update for Realtors. *** Want some help with your Facebook ads to bring in new leads and maximize your ROI? Drop me a line at [email protected]. -Norm :-) A quick note on liability:

There are things you can and can’t say in your ads based on national Fair Housing laws, state regulations, as well as independent broker and company rules. I’m going to assume that you know these and follow them, but be careful when talking about interest rates, pricing, neighborhood specifics like school systems, crime, demographics, and more. If in doubt, it’s a good idea to run your ad by your broker first! I just published an industry white paper on Apple Books and Kindle with Amazon.com. But instead of paying for it, I wanted to offer it to you here for FREE. This is a great eye-opener for mortgage brokers, lenders, and Realtors alike (yes, the same benefits apply to real estate agents!). You can download it here:

A sample from inside the special report: Instagram is also a terrific resource for mortgage brokers and loan officers who are looking to gain a larger client base, connect with Realtors for more referral business, and close far more deals this year (and who among us isn't looking for that?!) What will you get out of marketing (correctly) on Instagram? Leads, referrals, and more leads! In fact, 73% of consumers report that their purchase decisions are impacted by a brand's Instagram presence – including when it comes to getting their next home loan. Here are ten reasons why smart mortgage brokers and loan officers NEED to have a business profile on Instagram and actively market: (Want to read the rest? Just download the special report for free above ^^^)

Need a little help with Instagram marketing for your business? Just contact me! Your friend, -Norm :-) |

Categories

All

Archives

December 2020

|

||||||||||

Get in touch: |

RSS Feed

RSS Feed