And despite their meteoric growth, Luke helps LGCY Power deliver on their people-centric mission: "To become the best version of ourselves while helping others do the same."

In this super fun chat, Luke talks about his background in Utah, meeting Doug Robinson and together starting LGCY, what makes their solar company different, and his vision for the future of solar (which is now). We even got to talk some NBA hoops and Luke shares a little of his other passion: being a certified sneakerhead! You'll love the insight and authenticity that makes Luke such an integral part of LGCY Power. In fact, you can say he's absolutely legendary! -Norm Schriever Interviewer You can check out Luke Toone on IG @luketoone and LGCY Power at LGCYPOWER.com

0 Comments

He also comes to Golden Bay Mortgage Group with over 28 years of mortgage lending experience.

In his spare time, you will find Jai on the bike trail, fly fishing, spending time with family, or making home improvements. Jai has lived with his wife Janet in Sacramento for over 30 years, and they currently reside in South Land Park Terrace. To get in touch with Jai, feel free to email him at: [email protected] Thanks for listening! -Norm :-)

...as one of the fastest-growing companies, one of the best companies to work for, and many more. ☀️ But when Doug Robinson started the enterprise back in 2014, he had little more than a vision that solar and clean energy would “win” and the diligence to play the “long game” to see that through. ☀️ Together with co-founder Luke Toone, Doug has built LGCY Power into one of the nation’s premier sales firms in any industry, with a mission “to provide an extraordinary customer experience while becoming the best version of ourselves and helping others do the same.” ☀️ However, in this podcast, Doug and I talk very little about solar or even sales.

• Instead, we chat about his background, life experiences as a young man, and his LGCY “backstory,” • How the lessons he learned playing sports and college football translate to business leadership and teamwork, • Why his life’s work isn’t about sales or profits but empowering people to reach their potential and helping others, • A little adversity and a lot of hard work are part of the recipe of success, • The importance of perspective and focusing on what makes us the same – not different, • Doug’s belief in Tenacity, Talent, Timing in life, • The salesperson’s role as a wealth builder, • His unique notion of company culture and how he strives to implement and embrace that concept every day, • Some of the best books, coaches, and mentors that have helped him along the way, • And the advice he’d give himself as a young man. ☀️ Throughout this year, I’ve had the privilege of getting to know Doug as a boss and also a friend, and he's become someone I really respect. ☀️ So, I’m excited to share some of his business wisdom but also his humanity in this interview. -Norm Schriever :-) ☀️ For more information about Doug Robinson or LGCY Power, go to LGCYPower.com ☀️ Or follow LGCY Power on Instagram @lgcypower

In fact, wholesaling is a best-kept-secret among seasoned real estate investors, and that’s where Anish Dave comes in. As the co-founder of BREIA, the Broward County Real Estate Investors Association in south Florida, Anish is an accomplished investor who’s turned his focus to mentoring others. With a close affiliation to the National Real Estate Investors Association (NREIA), Anish delivers a unique mentoring and coaching model to neophyte investors. Instead of just educating their mentees and releasing them into the wild to fend for themselves, BREIA actually partners with their students, pounding the pavement, walking through homes, and even putting up 100% of the funds their students need to make these purchases. Anish is one of the savviest investors in the country when it comes to wholesaling, which means you buy low and sell a little less low, making potentially tens of thousands of dollars within a few hours of the purchase and at no risk. I’ve done a lot of work with Anish, his partner Ryan Kuhlman, and their organizations, and I can tell you that these guys are the real deal and really care. They make plenty of money, but that’s not all it’s about for them. And in this podcast, Anish also gives us some really apt analysis on where our current real estate market will turn, including a tsunami of distressed properties again, which has true investors licking their chops. I actually met Anish years back in a crazy social situation – a bachelor party week in Nicaragua (yes, you read that correctly!) where we barely got out unscathed, minus the bachelor, who left after the first night! Hence, that’s why I’m wearing my Nicaragua baseball jersey in this video interview with Anish. Enjoy this podcast interview with one of the best real estate investors you’ll ever meet - and enjoy one of the funniest stories you’ll hear at the very end about a Columbian condo, a new couch, and Pornhub! (NSF). To contact Anish for questions or mentoring, email Anish directly at [email protected] Or you can check out BREIA at https://breia.com. -Norm :-)  Meet Anish Dave Anish Dave has been in banking and financing since 1999 working with different financial institutions and owning his own mortgage company. He has been a realtor since 2004 working with large investment groups and developing initiatives with non-profit organizations in the South Florida market. His extensive background in financing has led him to close multi-millions in real estate transactions throughout his career. Anish was born in Ahmemabad, India and grew up in New Jersey. He has earned a degree of Bachelor of Arts in Finance from the University of South Florida. Anish has traveled extensively in Central and South America since living in Miami for the last eleven years. This in turn has given Anish the ability to evaluate different trends and evaluate markets, especially the foreclosure and short sale markets. Anish is always educating himself to keep ahead of a very dynamic market in South Florida. Anish has a vast knowledge of real estate and a specialty in short sales. He joined the Broward Real Estate Investors Association team to direct the new BREIA/MD-REIA Mentoring Program with Ryan Kuhlman. Anish is now the CEO of both the Broward Real Estate Investors Association and the Miami Dade REIA. Recently he received the Top Real Estate Investor of the Year award for 2016 from the International Association of Top Professionals (IAOTP). What is BREIA? The Broward Real Estate Investors Association is an organization and networking platform for real estate investors, real estate professionals and homeowners. It is our intention to educate and connect our community and to motivate people interested in real estate to achieve the success they desire. The ongoing education is endless, and as a result, hopefully your goals will continue to evolve and your success in the real estate business will increase from being involved with BREIA. In addition, BREIA provides a friendly atmosphere which promotes networking and allows all in attendance to grow by learning from other’s experiences. The founders of BREIA firmly believe that some of the best lessons have been learned from others who have chosen to share their experiences and save others from the school of hard knocks. As we are always expanding our network, BREIA has now expanded to Miami Dade with the newly formed Miami Dade Real Estate Investors Association. We have always been involved in real estate in Miami Dade county, but now we are building our corporate structure to have more of a foundation here in South Florida. Both BREIA and the MD-REIA are the only chapters of the National Real Estate Investors Association. This gives our members even more benefits leveraged by our connection with NREIA.

But she chose the best for last, becoming a managing partner at Empire Home Loans Inc., a people-centric mortgage firm in Sacramento, CA. Julie took that leap and was tasked with the most pivotal component of the whole operation: PEOPLE! “My strengths are found with people,” says Julie. “Coaching people, hiring people, and leading people – not just managing. So, my mandate with Empire Home Loans was always simple: to recruit the right talent, develop them, and put them in positions to succeed.” For instance, one of Julie’s goals with Empire is to use her platform as an owner to empower other women in business, helping them shatter the glass ceiling in the real estate and mortgage fields. That's no small feat, but if anyone can do it, it's Julie, who's graduated from some of the finest leadership, communication, and management courses in the world like the National Speakers Association NSA. She's also served as the PR Chairperson of the Sacramento CAMP Board for six years, co-chaired the Women's Round Table – a business mastermind group, and graduated with distinction from Future Leaders, CMBA through Pepperdine University. Not only will she serve as an ambassador to loan officers who want to join the Empire Home Loans team and learn how to thoroughly outpace the competition but use her vast experience to create the best user experience in the entire mortgage industry. Anywhere. Period. “It’s my job to establish our marketing and branding, but, most importantly, to drive a winning culture. The main reason why the three of us are such great partners is that our talents are all so different. I say culture eats strategy for breakfast … and Anthony says a great strategy should include culture. Of course, we’re both right – as long as the client benefits!” Enjoy this podcast with Julie Yarbrough, the coolest mortgage broker you know! 😎 -Norm :-) PS Want to get in touch with Julie or hear more about Empire Home Loans? You can email her here.

That’s scary! And just because you make well into six figures as a Realtor, loan officer, or small business owner, it doesn’t mean immune from financial worries. We all should be investing in education and planning for a better financial future. So, today I’m enlisting the help of one of the premier financial planners to do just that: Brian Boyd. Brian, who also happens to be a great friend of mine from when I lived in Sacramento, Ca, is the founder and principal of Boyd Wealth Management, an elite financial planning firm that deals with high net worth individuals. I know…there are a lot of great financial planners out there (in their own estimation), but I’ll tell you what makes Brian different: He operates on an extremely high level on behalf of his circle of clients, but still believes in transparency and simplicity. It was Albert Einstein who said that the mark of true genius is being able to take a very complex topic and explain it simply (I’m paraphrasing), and Brian manages to do that with aplomb. So, I was thrilled and honored that he took a couple of hours out of his bustling schedule to jump on the podcast and offer some sage wisdom about what his wealthy clients understand about money and finances that the average person may not. We could all tighten up our knowledge, planning, and discipline when it comes to investing and managing our finances, and you’ll be closer to that goal just by listing to Brian’s wisdom. Enjoy - and feel free to check out Brian by subscribing to his insightful financial newsletter by clicking here. Your friend, Norm :-) The Boyd Wealth Management investment philosophy:

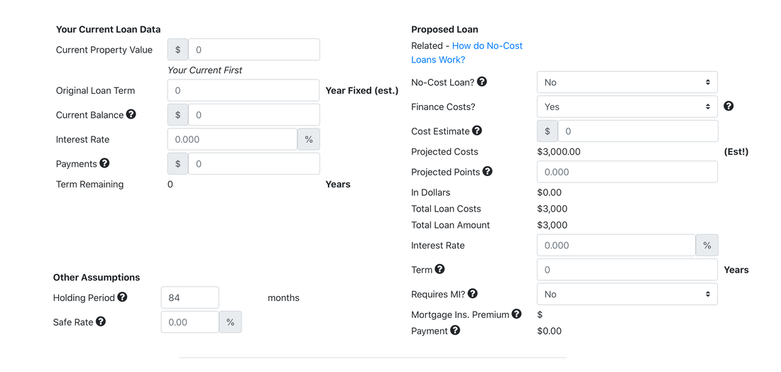

For instance, many of us approach (or sell) a refinance like this: If we lower your interest rate by .5 percent (as an example), you’ll save $300 per month going forward - and the cost of the refinance will pay for itself in 2 years. Of course, that logic looks familiar. Except there’s one small problem: these mortgage calculators are WRONG! Incredibly, the equation that most of us are using when we put numbers into a refinance savings calculator is dead wrong. As you’ll hear and see in this podcast with Casey Fleming, there’s one essential element these refinance calculators miss: amortization. Sure, they allow you to input how long you’d like to amortize a new loan (like over 30 years), but it didn’t account for how far into the amortization curve your CURRENT mortgage loan is when you refinance. And as we know, the true cost of your loan is based on principle, interest, and TIME, since the amortization curve is so steeply in favor of interest early in the loan. This universal shortcoming was brought to my attention by Casey Fleming, a gentleman who’s spent his storied professional career refining the technical aspects of mortgage lending. Living in California’s Silicon Valley, Casey’s client base was predominately made up of computer engineers, who demand unwavering scrutiny with every number and scenario. However, even back when most mortgage calculators were on Excel spreadsheets, an engineer pointed out to him that the math was incomplete because it failed to account for one variable: how far along the homeowner currently is in their amortization schedule. But just because he knew what was missing, it didn’t mean it was easy for Casey to correct the problem, and he spent significant time and energy redrafting the correct mortgage calculations, like a mad professor. The result is that Casey Fleming most likely has one of the only mortgage refinance calculators that's 100% accurate.  It’s also held up under scrutiny by engineers, computer scientists, and mathematicians ever since. This epiphany led Casey to write The Loan Guide: How to Get the Best Possible Mortgage, an incredibly in-depth manual for any consumer or even mortgage lender. I don’t expect this information to be popular with the current mortgage lenders and brokers, as we’re all used to the status quo and industry standard of demonstrating why a refinance makes sense and how much it will save the borrower. But Casey just gives accurate information, not his opinion on sales, and points out that by doing things accurately, you can better serve your clients and earn their trust and business for life. He offers his revolutionary Refinance Benefit Analysis calculator for free on his website, LoanGuide.com. On that website, you’ll also find mathematically accurate mortgage calculators based on borrowing money to do long-term home improvements, what's the ROI if you're investing your mortgage savings at a certain interest rate, making extra payments to impact the total loan cost, and more. Whether you’re an experienced mortgage broker or loan officer; Realtor or consumer looking to refinance, you’ll be amazed at the insights Casey Fleming brings us today in this podcast. Your friend, -Norm :-) Thoughts? Feedback? Hate mail? Send me an email at [email protected]!

But he felt the calling to spend more time in the Philippines, where his family is from, and fell in love with the Southeast Asian nation of 7,500 islands.

Fast forward a couple of short years and Noel is moving and grooving in Manila, becoming one of the most notable entrepreneurs and branding icons in the country. So, what's the secret that's allowed him to achieve massive success in not one but two hemispheres? Noel only works on projects that are fun and inspire his passion, and focuses more on helping and connecting others than promoting himself. The result is that he's got the top networking lounge in Asia and one of the top up-and-coming podcasts, All In. Enjoy this conversation with Noel about his background in advertising, his journey to the Philippines, his mission to empower others, and why he's actually optimistic about the future! Give a big thank you and 'salamat' to Noel for sharing his time and check out his podcast! -Your friend, Norm :-)

was one of the best experiences of my life, not only because of the training but the people I met there, including the club's owner, Cary Williams.

I became friends with Cary and over the years, always admired her knack for marketing, self-promotion, and never-ending hustle. Of course, I also respected her because she is a hell of a boxing coach and really knows her stuff! Since then, Cary has moved to Los Angeles, where she owns The Stables boxing club and does her thing to a bigger audience. In this podcast, I chat with Cary about boxing but also business, including the challenges of being a female small business owner in a predominantly mens' sport. Enjoy this fun chat with Cary Williams and to find out more, here is an excerpt from her bio at CaryWilliams.com. -Norm :-) *** Cary Williams is a former Olympic style boxer, Olympic level boxing coach, boxing club owner, cover model, speaker and entrepreneur. She has now created Boxing & Barbells which is a class format fusing boxing and weight training together in a fun and easy to learn format. Cary has contributed to SHEKNOW.COM, EHOW.COM, LIVESTRONG.COM and ADRENALIST.COM and has been a guest on many radio shows and television news shows. Cary has been recognized by The California Legislature along with Brandi Chastain and several other women in sports for her contribution and impact on girl’s sports. In the boxing world, Cary boxed competitively in the amateurs and won the Pacific Northwest Women’s Tournament before hanging up her gloves. She is a Level IV Boxing Coach and was also selected by USA Boxing to certify trainers as LEVEL I and Level II USA Boxing coaches. She also received a certificate of completing for the Elite Boxing Coach Clinic at the Olympic Training Center. Cary has trained many boxers, some of which have made it to Olympic Trial Qualifying Tournaments. To get in touch with Cary, follow her on Instagram @caryleewilliams or @thestablessm

On this Zoom beer & chat in late March 2020 (it was nice and warm in Florida for Tim but freezing on my mom's front porch in Connecticut!) we talk about the state of the industry, best practices, dispel some common myths.

We also get Tim's sage advice on what the average Realtor, mortgage lender, or small business owner can do to boost their brand online. To get in touch with Tim Schmidt, hit him up at TimSchmidt.com. Your friend, -Norm :-) |

The real estate marketingw/ Norm Podcast!Connecting, informing, and empowering the real estate, mortgage, and small business community. Archives

October 2020

Categories |

Get in touch: |

RSS Feed

RSS Feed