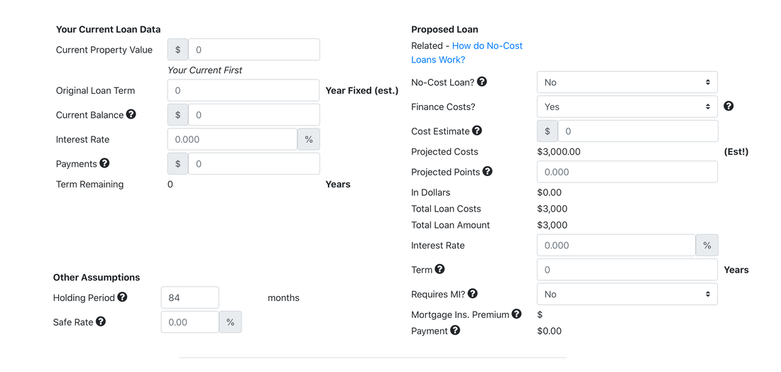

For instance, many of us approach (or sell) a refinance like this: If we lower your interest rate by .5 percent (as an example), you’ll save $300 per month going forward - and the cost of the refinance will pay for itself in 2 years. Of course, that logic looks familiar. Except there’s one small problem: these mortgage calculators are WRONG! Incredibly, the equation that most of us are using when we put numbers into a refinance savings calculator is dead wrong. As you’ll hear and see in this podcast with Casey Fleming, there’s one essential element these refinance calculators miss: amortization. Sure, they allow you to input how long you’d like to amortize a new loan (like over 30 years), but it didn’t account for how far into the amortization curve your CURRENT mortgage loan is when you refinance. And as we know, the true cost of your loan is based on principle, interest, and TIME, since the amortization curve is so steeply in favor of interest early in the loan. This universal shortcoming was brought to my attention by Casey Fleming, a gentleman who’s spent his storied professional career refining the technical aspects of mortgage lending. Living in California’s Silicon Valley, Casey’s client base was predominately made up of computer engineers, who demand unwavering scrutiny with every number and scenario. However, even back when most mortgage calculators were on Excel spreadsheets, an engineer pointed out to him that the math was incomplete because it failed to account for one variable: how far along the homeowner currently is in their amortization schedule. But just because he knew what was missing, it didn’t mean it was easy for Casey to correct the problem, and he spent significant time and energy redrafting the correct mortgage calculations, like a mad professor. The result is that Casey Fleming most likely has one of the only mortgage refinance calculators that's 100% accurate.  It’s also held up under scrutiny by engineers, computer scientists, and mathematicians ever since. This epiphany led Casey to write The Loan Guide: How to Get the Best Possible Mortgage, an incredibly in-depth manual for any consumer or even mortgage lender. I don’t expect this information to be popular with the current mortgage lenders and brokers, as we’re all used to the status quo and industry standard of demonstrating why a refinance makes sense and how much it will save the borrower. But Casey just gives accurate information, not his opinion on sales, and points out that by doing things accurately, you can better serve your clients and earn their trust and business for life. He offers his revolutionary Refinance Benefit Analysis calculator for free on his website, LoanGuide.com. On that website, you’ll also find mathematically accurate mortgage calculators based on borrowing money to do long-term home improvements, what's the ROI if you're investing your mortgage savings at a certain interest rate, making extra payments to impact the total loan cost, and more. Whether you’re an experienced mortgage broker or loan officer; Realtor or consumer looking to refinance, you’ll be amazed at the insights Casey Fleming brings us today in this podcast. Your friend, -Norm :-) Thoughts? Feedback? Hate mail? Send me an email at [email protected]!

0 Comments

But he felt the calling to spend more time in the Philippines, where his family is from, and fell in love with the Southeast Asian nation of 7,500 islands.

Fast forward a couple of short years and Noel is moving and grooving in Manila, becoming one of the most notable entrepreneurs and branding icons in the country. So, what's the secret that's allowed him to achieve massive success in not one but two hemispheres? Noel only works on projects that are fun and inspire his passion, and focuses more on helping and connecting others than promoting himself. The result is that he's got the top networking lounge in Asia and one of the top up-and-coming podcasts, All In. Enjoy this conversation with Noel about his background in advertising, his journey to the Philippines, his mission to empower others, and why he's actually optimistic about the future! Give a big thank you and 'salamat' to Noel for sharing his time and check out his podcast! -Your friend, Norm :-) |

The real estate marketingw/ Norm Podcast!Connecting, informing, and empowering the real estate, mortgage, and small business community. Archives

October 2020

Categories |

Get in touch: |

RSS Feed

RSS Feed